direct deposit owner's draw quickbooks

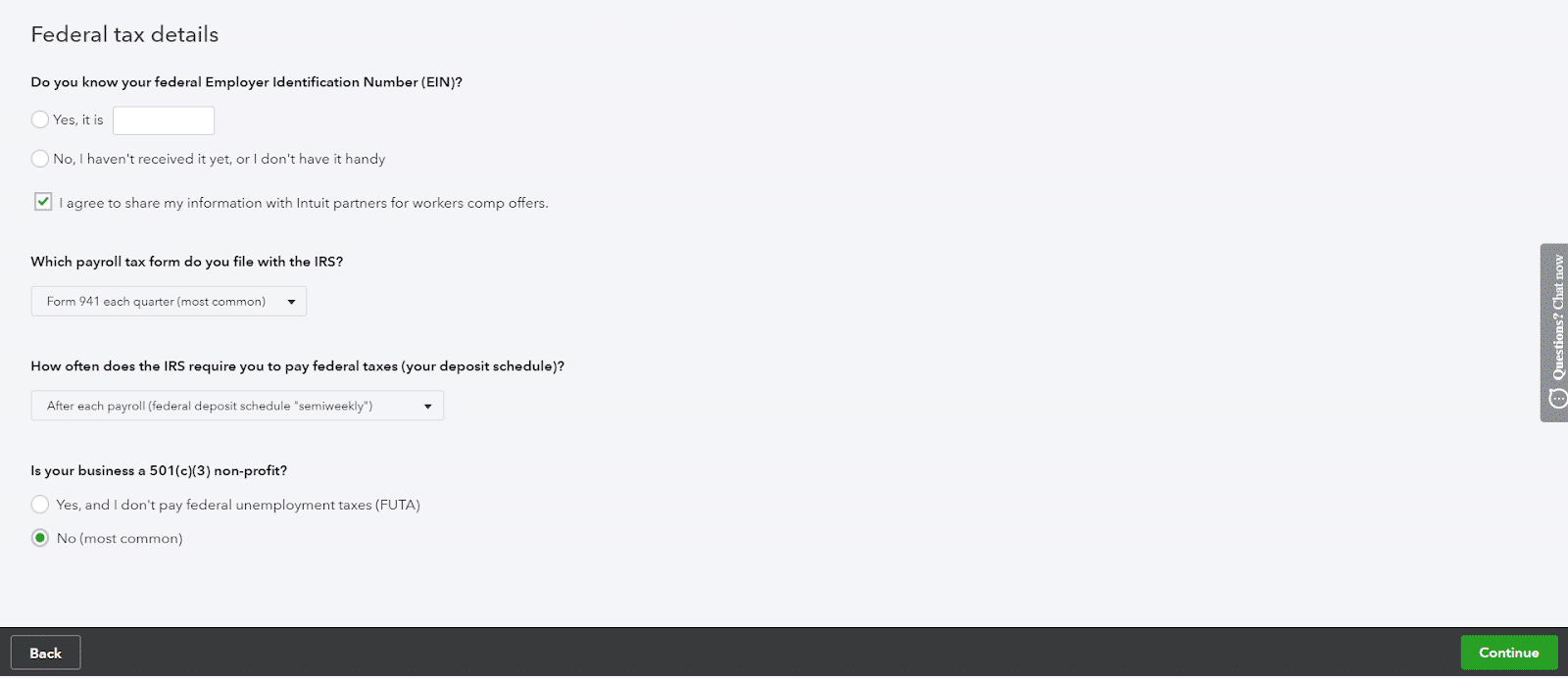

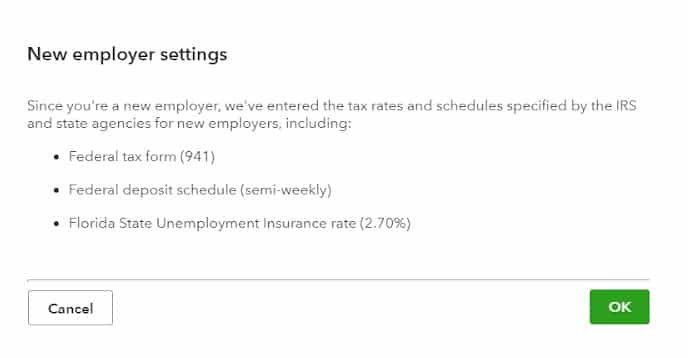

Enter an opening balance and hit Save and close. To set up your company for direct deposit in QuickBooks verify your companys information including the legal name address EIN and industry.

Quickbooks Training Purchase Order For Inventory And Receive Inventory Quickbooks Quickbooks Training Consulting Business

Enter the bank account info from the employees voided check.

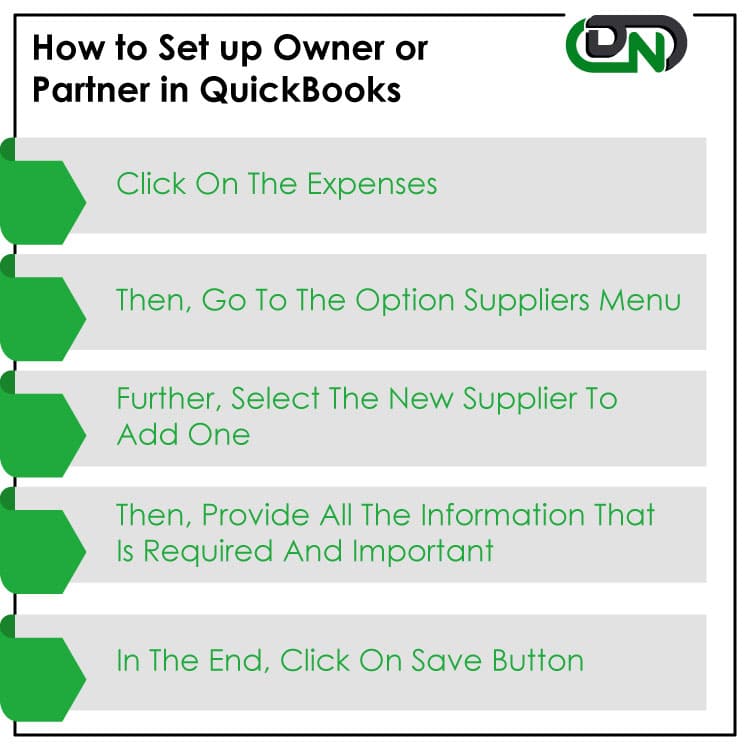

. Recording draws in Quickbooks requires setting up owner draw. Click the New option at the upper right. An owners draw account is a type of equity account in which QuickBooks Desktop tracks withdrawals of assets from the company to pay an owner.

Enter an opening balance. You can either set up your direct deposit while setting up payroll or by going to EmployeePayroll InfoDirect Deposit. Set up direct deposit for QuickBooks Payroll.

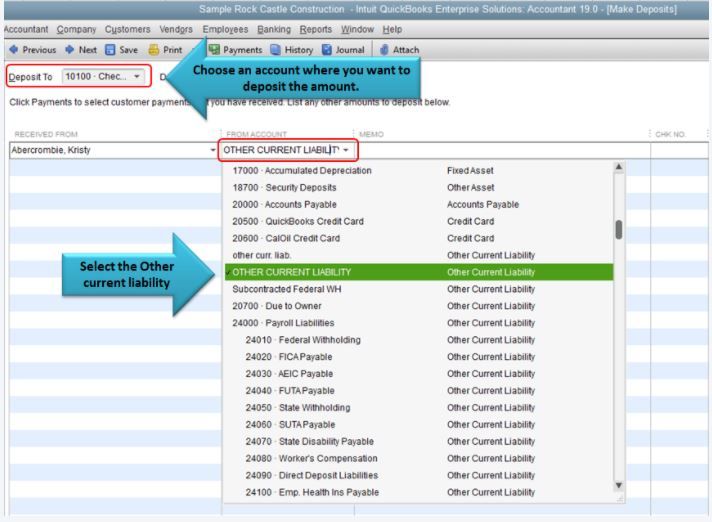

How to Record Owner Draws Into QuickBooks. In the Payments to Deposit window you need to select the payments you wish to combine. This article describes how to Setup and Pay Owners Draw in QuickBooks Online Desktop.

Theres a monthly fee for each contractor you add to direct deposit. Visit the Lists option from the main menu followed by Chart of Accounts. Details To create an owners draw account.

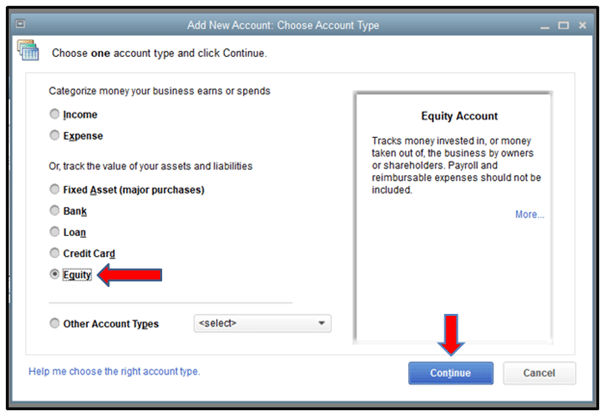

In the first step you are required to hit on the Tools on the QuickBooks accounting software menu bar and choose the Add Account. This has always been ok up until now. In this video we demonstrate how to set up equity accounts for a sole proprietorship in Quickbooks.

When you can see these deductions recorded on your bank statement you can activate direct deposits in QuickBooks. In the second step you need to mention the name for the petty cash account in the Account NameNickname text box. When you enter bills from your vendor invoices in QuickBooks Desktop you have the option to pay them through Direct Deposit.

Click Save Close. Select Edit next to the Pay method. In QBO go to the Accounting menu at the left pane to get to the Chart of Accounts page.

Enter the account name Owners Draw is recommended and description. You need to set it up. Before you can record an owners draw youll first need to set one up in your Quickbooks account.

To pay your vendors through direct deposit. Select Direct Deposit and enter the bank account info from the voided check. Account is Shareholded Distribution an equity account.

You may have already done this for your full-time W2 and W4 employees. Quickbooks is confusing its users on this topic. The effect of recording an advance payment correctly in QuickBooks is that the deposit is added to a current liability account the credit and to a cash account the debit on the balance sheet.

Pay bills from your vendors through Direct Deposit. Create the paychecks in QuickBooks. Start paying employees using Direct Deposit.

Select the contractors Pay Method then Edit. Select Use Direct Deposit for checkbox and then select whether to deposit the paycheck into one or two accounts. Choose Lists Chart of Accounts or press CTRL A on your keyboard.

If you havent already set up direct deposits for your contractors in QuickBooks Online. Once you have your slip of the deposited balance from your bank youre ready to record. Fill in the check fields.

Set up your vendors for Direct Deposit Step 3. You have an owner you want to pay in QuickBooks Desktop. Make payments in real life.

Direct deposit with balance as a check. If you have any video requests or tutorials you would like to see make sure to leave them in the com. Choose the bank account where your money will be withdrawn from.

Get set up to ACH from your checking account. Heres how to access the authorization for direct deposit form in QuickBooks Online. From here choose Make Deposits and then select the bank account where youd like to deposit your personal investment.

If youre curious about the notion of tracking the withdrawal of company assets to pay an owner in QuickBooks Online keep. Click on Taxes and Forms. Sign up for the Direct Deposit service Step 2.

Direct Deposit in the Employee Information section. We also show how to record both contributions of capita. Update any owner information if needed.

Dont forget to like and subscribe. Select Equity and Continue. Click Equity Continue.

Add it if you dont have it. Select Save and Close. Finally record them in QB.

Setting Up an Owners Draw. Direct deposits isnt a default feature. Pick Equity in the Account Type drop-down then choose Owners Equity in the Detail Type.

When the owner of a business takes money out of the business bank account to pay personal bills or for any other personal expenditures the money is treated as a draw on the owners equity in the business. In the Category field be sure to select Owners equity you created. For verifying the bank accounts QuickBooks levies two small verification deductions.

When you attempt to make a direct deposit payment to an owner it specifically says something like in order to comply with the law direct deposit payments can only be made to independent contractors. Once done heres how to write a check. At the bottom of the Chart of Accounts page you should see an option titled Accounts click it and choose New.

Recording a Bank Deposit in the QuickBooks to Combine Payments. On the Homepage you need to choose Record DepositsMake Deposits. On the Add Account window you need to hit on the Cash link.

This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. Direct deposit to 2 accounts. Write a check from an owners equity account.

The memo field is optional. To write a check from an owners. Set up and Process an Owners Draw Account.

Enter the employees financial institution information and then click OK to save the information. At the bottom left choose Account New. From the Detail Type dropdown choose Owners Equity.

Verify the Activated Direct Deposits in QuickBooks. In this learn QuickBooks training tutorial you will learn how to record cash investment in to the company deposited by the owner from his her own money p. If you want to one-step direct deposit you have to have each shareholder set up as a Vendor and have a payroll subscfiption.

Once you have activated direct deposits in QuickBooks you need to verify it as well.

Free Direct Deposit Authorization Forms 22 Pdf Word Eforms

Tutorial Pay A Contractor With Direct Deposit Quickbooks Online Youtube

.png)

Quickbooks Online Tag Tricks You Need To Know Berrydunn

How To Set Up Pay Payroll Tax Payments In Quickbooks

Solved One Company Ein Two Locations Two Payroll Bank A

Get Our Sample Of Direct Deposit Authorization Form Template Quickbooks Payroll Payroll Directions

How Do I Pay Myself Owner Draw Using Direct Deposi

How Do I Pay Myself Owner Draw Using Direct Deposi

Owner S Draw Via Direct Deposit Quickbooks Online Tutorial The Home Bookkeeper Youtube

Setup And Pay Owner S Draw In Quickbooks Online Desktop

How To Run Payroll And Set Up Direct Deposit In Quickbooks Online Payroll Youtube

How To Record Owner Investment In Quickbooks Set Up Equity Account

Solved Owner Has Been Incorrectly Taking Owners Draw Inst

How To Pay Employees With Direct Deposit In Quickbooks Desktop Payroll Youtube

How To Record Owner Investment In Quickbooks Set Up Equity Account

/INV-how-to-void-a-check-4797998-eb85b5eaea2748e6b023e9da567ed21e.jpg)